Adjustments for Which of the Following Involves the Cash Account

Only balance sheet accounts. Retained earnings at the beginning and end of the year totaled 25000 and 75000 respectively.

Adjusting Entries For Asset Accounts Accountingcoach

Adjusting entries that convert assets to expenses.

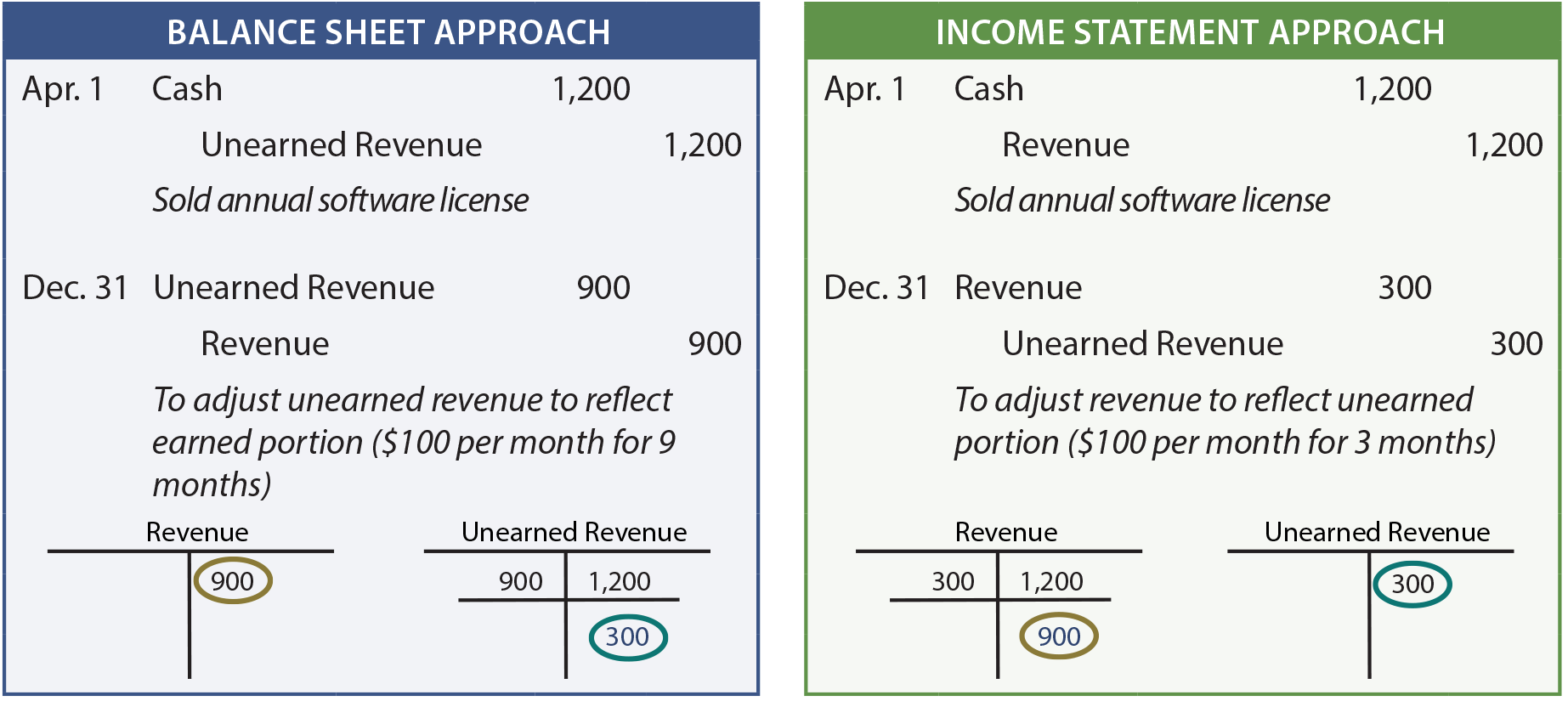

. Shift prepayments to suppliers. Which of the following adjusting entries involves the. Shift these transactions to sales in the period when the cash was received.

View Test Prep - Chapter 4 Income Measuremen 15 from MATH 451 at University of Michigan. If customers paid in advance for their orders these payments would have been recorded as liabilities under the accrual basis. None of these are correct.

If revenues exceed expenses for the accounting period the income summary account. A Unearned Service Revenue. Unless a company pays salaries on the last day of the accounting period for a pay period ending on that date it must make an adjusting entry to record any salaries incurred.

Hence there is a need to adjust the account balances. They are accrued revenues accrued expenses deferred revenues and deferred expenses. The last payday occurred on December 26 as shown in the 20X8 calendar that follows.

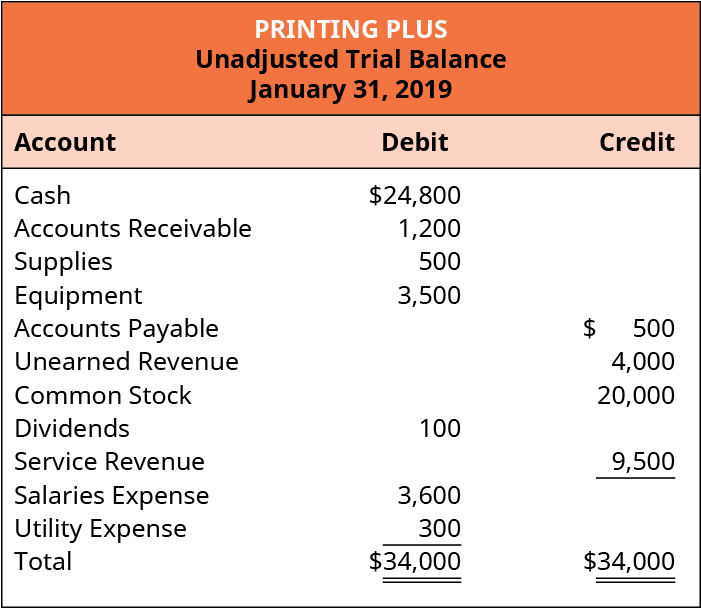

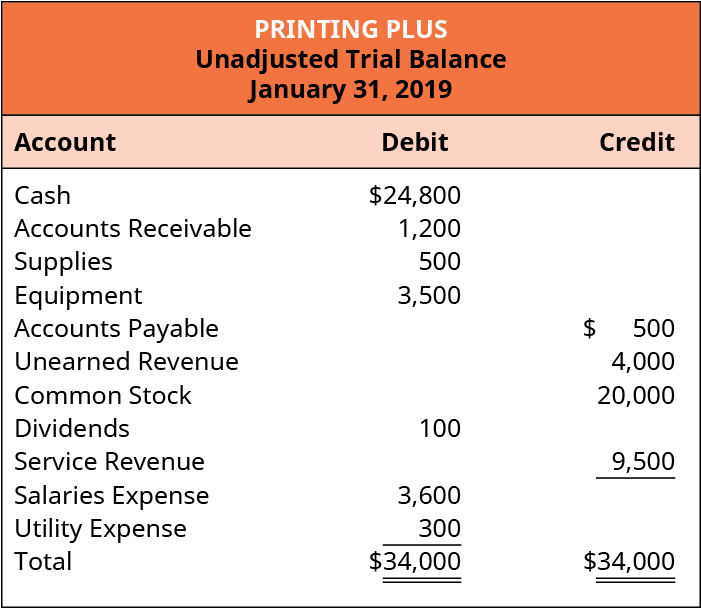

At least one income statement account and one balance sheet account. Adjusting entries involve at least one balance sheet account and one income statement account. Employees worked three days the following week but would not be paid for this time until January 9 20X9.

The main purpose of adjusting entries is to update the accounts to conform with the accrual concept. Identifying changes in financing-related accounts. Uncovered the following items.

As of the end of the accounting period the company owes employees 3000 pertaining to December 29 30 and 31. The recording of the payment of employee salaries usually involves a debit to an expense account and a credit to Cash. B Will have a debit balance prior to closing.

Expressed another way accrual adjusting entries are the means for including transactions that occurred during the current accounting period but have. Adjusting entries affect profit or loss. Uncovered the following items.

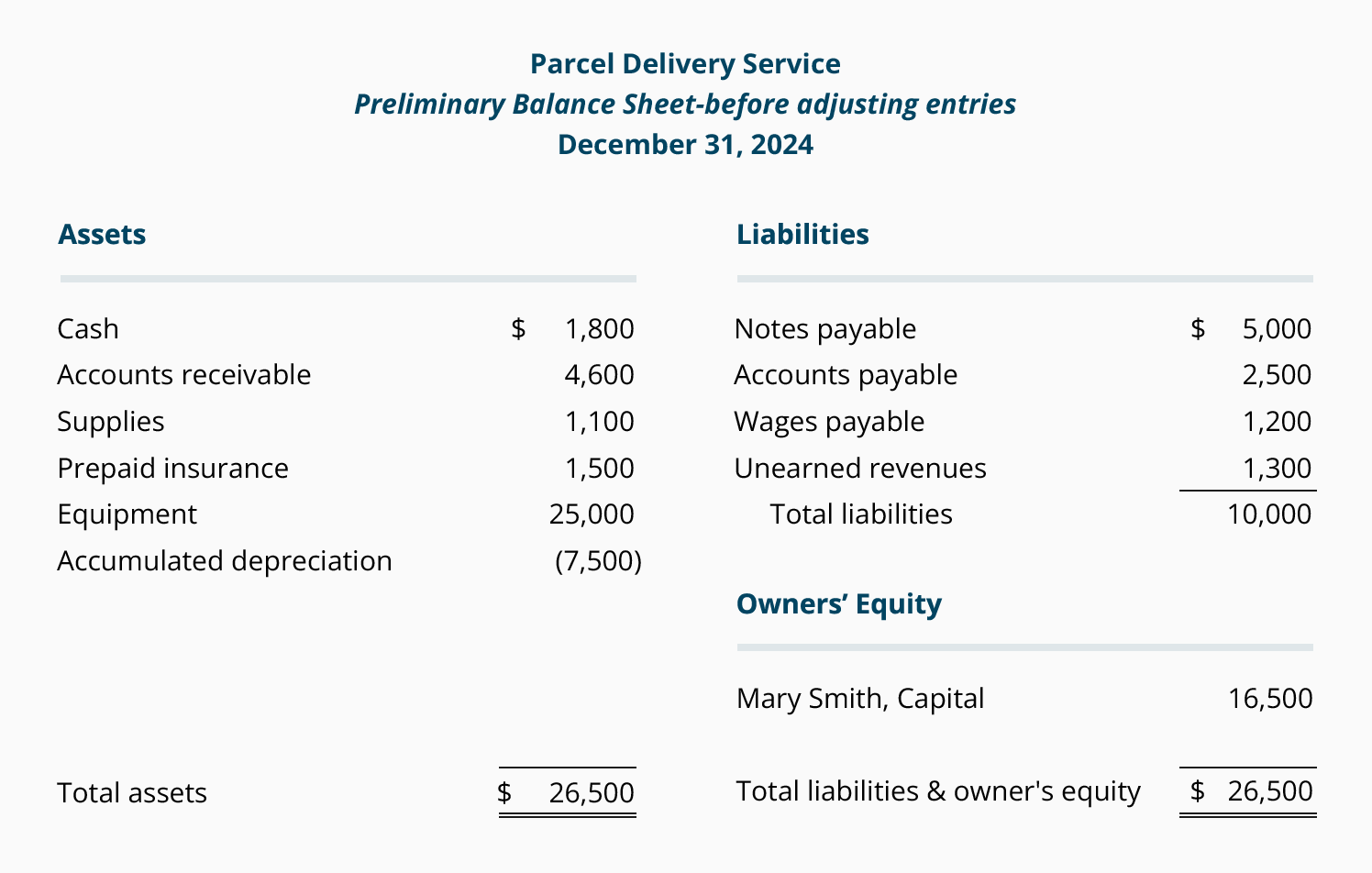

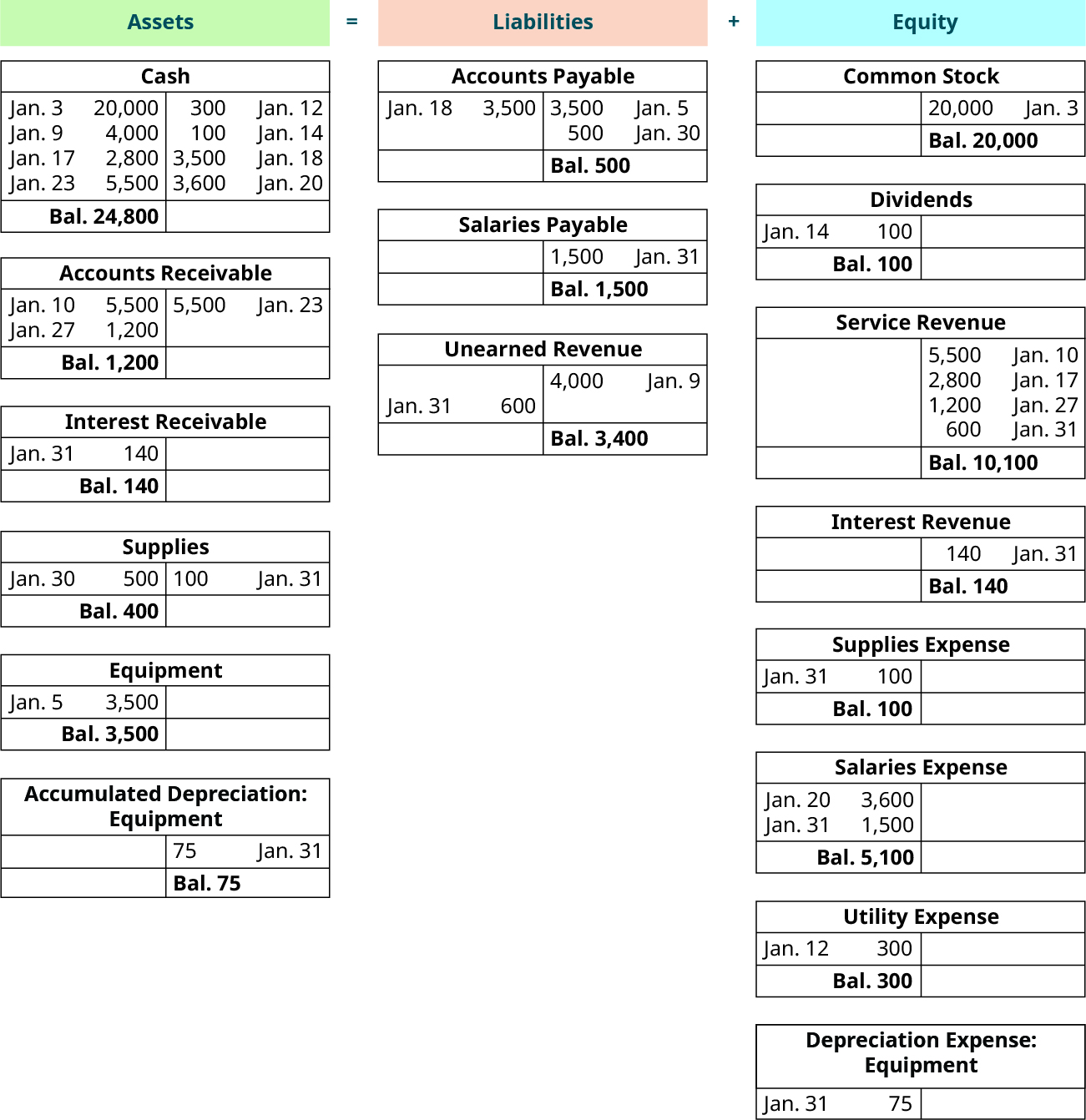

1 An accountant who uses the accrual basis of accounting receives cash in advance for services yet to be performed. Enter the preliminary balance in each of the T-accounts. Examples of such expenditures include advance payment of rent or insurance purchase of office supplies purchase of an office equipment or any other fixed asset.

Accrual adjusting entries or simply accruals are one of three types of adjusting entries which are prepared at the end of an accounting period so that a companys financial statements will comply with the accrual method of accounting. C Closing out the permanent account balances. If adjusting entries are not prepared some income expense asset and liability.

Liabilityexpense adjustmentsinvolves accrued. An analysis of comparative balance sheets the current years income statement and the general ledger accounts of Hailey Corp. The carrying value of an asset is an approximation of the assets market value.

Determine what the ending balance ought to be for the balance sheet account. Make an adjustment so that the ending amount in the balance sheet account is correct. At the end of the following year then your Insurance Expense account on your profit and loss statement will show 1200 and your Prepaid Expenses account.

Write the adjusting journal entry. The four adjustments in bank reconciliation include. At the end of the accounting period some income and expenses may have not been recorded or updated.

This may require an adjustment to the beginning retained earnings account. Adjusting entries often involve cash. Depreciation is a measure of the decline in market value of an asset.

Which of the following is incorrect regarding adjusting entries. If the company pays in advance. All of the following are types of adjustments except a.

As a company uses supplies an adjustment should be made to decrease an asset account and increase an expense account. The entry to record this transaction will include a credit to which of the following accounts. An analysis of comparative balance sheets the current years income statement and the general ledger accounts of Hailey Corp.

Adjust credit for all students. This problem has been solved. Hence the easiest way of preparing the bank reconciliation is to consider the reasons for the differences and record the reconciliation items or adjust add the entry in the accounting record based on the types of difference.

5200 Cash flow from financing act. Explaining the changes using T-accounts and reconstructed entries. Indicate where each item should be presented in the statement of cash flows indirect method using these four.

Transactions initiated by the bank. In laymans terms to accrue means to accumulate while to defer means to postpone. Assume all items involve cash unless there is information to the contrary.

There are four types of account adjustments found in the accounting industry. A Will have a debit balance after closing. Assume all items involve cash unless there is information to the contrary.

The following accounts and balances were drawn from the records of Barker Company at December 31 2018. Enter the same adjustment amount into the related income statement account. Adjusting entries are done to make the accounting records accurately reflect the matching principle match revenue and expense of the operating period.

5000 Prepaid insurance 1200 Rent expense 2500 Service revenue 65200 Dividends 3000 Other operating expenses. C Will have a. Supplies 1000 Beginning retained earnings 9300 Cash flow from investing act.

Some cash expenditures are made to obtain benefits for more than one accounting period. It doesnt make any sense to collect or pay cash to. Indicate how each item should be classified in the statement of cash flows using these four major classifications.

Reporting the cash flow effects. Which of the following adjusting entries involves the Cash account. 33 Adjust the accounts.

This can get a. D None of the above. Adjusting entries will never include cash.

See the answer See the answer done loading.

Accounting Cycle Accounting Notes Accounting Cycle Accounting

The Adjusting Process And Related Entries Principlesofaccounting Com

Discuss The Adjustment Process And Illustrate Common Types Of Adjusting Entries Principles Of Accounting Volume 1 Financial Accounting

Record And Post The Common Types Of Adjusting Entries Principles Of Accounting Volume 1 Financial Accounting

No comments for "Adjustments for Which of the Following Involves the Cash Account"

Post a Comment